Lessons learned from Horizon65 on the problems facing private pensions in Europe.

Horizon65 is an insurtech focussed on private pensions

Four years ago, I learned about a new regulation called the Pan-european Pension Plan and got so excited about the prospect of creating a pan-european pension fund that I started Horizon65 (The “65” refers to the average real retirement age).

Since then, I’ve learned a lot about how retail investors think and have lost the conviction that within the existing legal and regulatory frameworks a successful private pension proposition can be built.

In this post, I will leverage my learnings from Horizon65 to illustrate what it takes to build a successful private pension proposition from a government POV.

I have spoken to 100s of retail investors and many players in the industry.

Private pensions are too complicated for financially unsophisticated investors

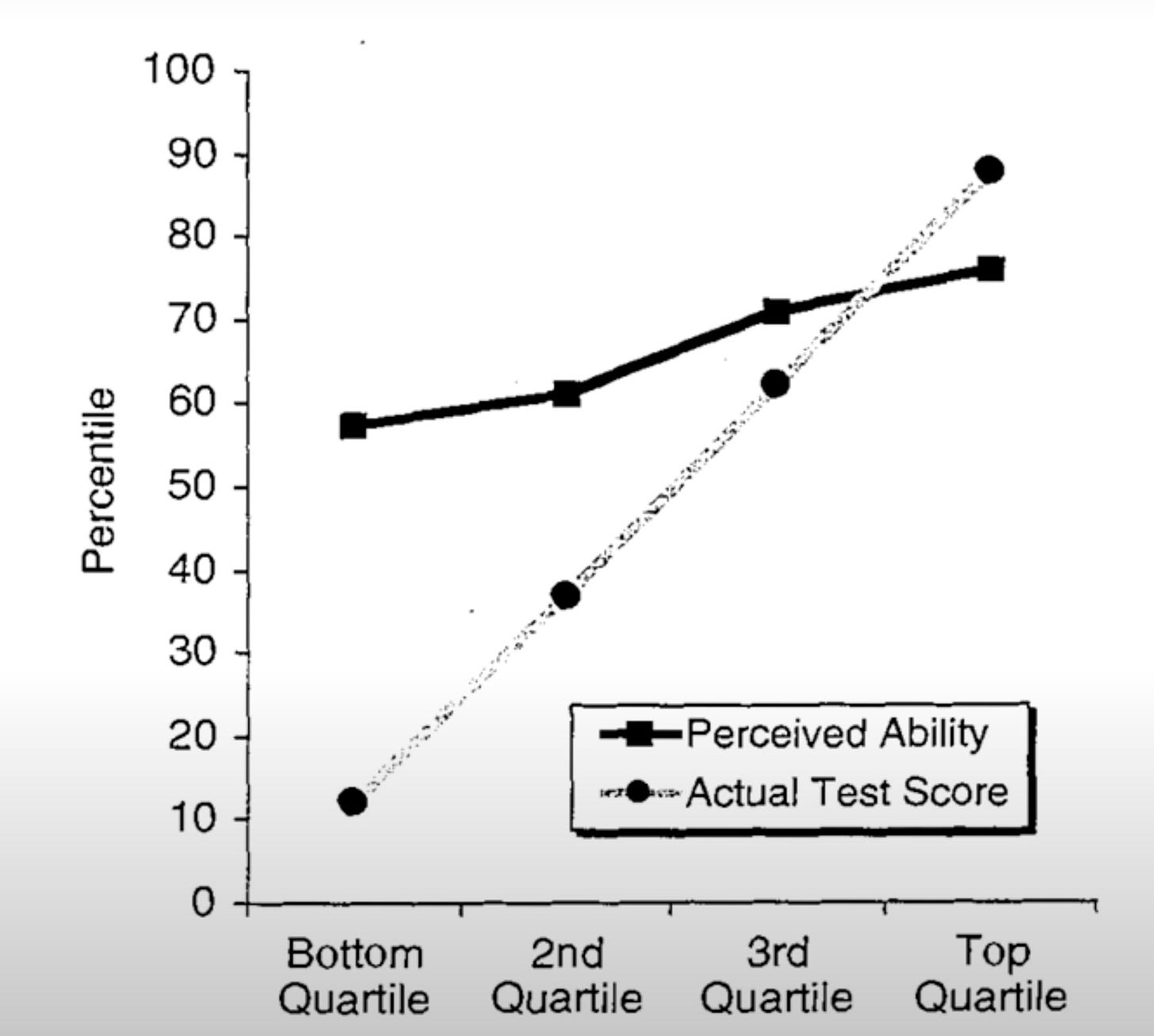

When speaking with people interested in investing in their pension it becomes very quickly apparent that most people are clueless about finance, even though if you ask them 80% will say they know a lot about finance which is very similar to the 80% of people who believe they are smarter than average.

The Dunning-kruger effect is super real in retail investing.

Yet, private pensions and finance products in general are full of information they don’t understand and what you often hear is that investors don’t have time but what they actually mean is that every time they make time to look into it, they are still confused and decide they need more time.

Retail investors are fundamentally stuck in analysis-paralysis.

It's not a coincidence that most money is sitting in bank and savings accounts.

This problem is compounded by the fact that life insurances require biometric signatures and large contracts full of terms the client does not understand.

Those contracts cover inheritance planning, tax-deferral, fund selection, guarantees, expected outcomes, opaque fee structures, etc…

You can hardly make them look more scary.

That said, I do not mean to imply that all those concepts are not understandable by retail investors. It’s just that it’s a lot to learn and it’s hard to achieve confidence that you understand it well on your own.

Advisors are a solution but they are labour-intense

This is why the largest capital pools are often accumulated through advisory such as Evli in Norway and Octopus Investments even despite the founder of Octopus Investments being against advisors initially, he realized that it was the only way to scalable acquisition of assets under management.

This is also why private pensions somewhat work in Germany. Germany has large tax incentives and allows for commission-based advice.

This commissions are high enough that a sufficiently sophisticated person can go through the motions for every potential client to explain basic finance concepts and to introduce all this without sinking their confidence and with that their willingness to invest.

Private pensions in the Netherlands however do not work at all. The economics are just not there to support advisors and private pension products are not profitable to offer.

Contrary to popular believe commissioned advisors are not the issue, while they add fees, they also answer all the questions people have and convince people to actually invest.

There is however a very strong advisory talent problem, from my experience hiring pension insurance experts for my business I can tell you that there are many people in the business who have no idea how pension products actually work.

There are obviously also the ones that screw the client with high fees in order to get a bigger commission but this mostly happens in big brand companies, in small unknown companies such as Horizon65 we always had to fight to gain the clients trust and we have zero tolerance for stuff like that.

Keeping it simple and just getting them started works

Investment fintechs such as Trade Republic have hit on a low-touch model where they essentially pay you money to get started investing and they hope that you build your confidence along the way to commit larger and more regular sums of money.

It works and it also works because there are no restrictions on what you can do with your money.

This essentially leverages overconfidence with zero or low capital committed to get people started.

Sadly, this doesn’t work for private pension contracts because the government does place restrictions on what you can do.

It works but it doesn’t actually help too much in securing people’s pensions.

First, a lot of them withdraw the money for big expenses (e.g. a car) but direct (non-tax shielded) investing performs insufficiently to cover your pension needs in the future.

That said, it is a good method to get retail investors started.

Retail investors are cheap

In any case, there is very low willingness to pay advisors upfront and there is also a lot of overconfidence that they don’t need advisors.

This mostly comes down to retail investors don’t want to pay fees.

Especially not upfront, but they do want to pay after they have received good advice. This leaves a conundrum to which commission-based advice is the only viable answer.

AI will probably take those advisors jobs now, which is a good thing although the AI so far has been mostly wrong when it comes to private pension contracts.

Retail investors put a high premium on liquidity

Many European pension plans with tax advantages lock in the money until you retire.

This makes sense from a government POV, you are only willing to give tax advantages when the money is used for retirement but this causes a huge amount of friction.

To the point that many clients chose to forgo income tax-deferral in favor of liquidity.

A scheme were tax reductions are paid-in directly and those are withdrawn if the person withdraws money is a much better system

Retail investors follow their “finance friend”

This is a very important insight if you want to create a successful financial product. In essence retail investors follow the investment recommendations of people who they believe are doing well.

This can be their father, an uncle, the guy at work who talks a lot about finance, …

We call this the finance friend but sadly it can also be the get-rich-quick crypto guy who bets on shitcoins all day and only brags about it when he makes money but never mentions it when he loses money.

Regulators heavily restrict investment options in private pension plans.

While everybody would understand you don’t include crypto, you should definitely include individual stocks, gold and other commodities into it.

The most important is to not hinder retail investors to put money inside the pension plan.

At a later time, they can decide stocks are not a good idea and invest in safer products.

That’s a pattern that we have seen many times in our user research. People give up on active trading after they lose money and switch to passive.

When they do invest passively they typically select widely socialized (e.g. popular online) indexes to invest in.

MSCI World

S&P 500

MSCI USA Technology (Nasdaq)

They could also select the ESG equivalent if they are environmentally concerned.

Retail investors are both active and passive

You will find retail investors that are active investors but claim to be passive investors such as adjusting their portfolio every month.

Here advisors are actually a very good thing to have because they typically calm the client down and explain the importance of consistent deployment.

But it should be possible for retail investors to trade freely and exit into cash positions, at least inside the same contract.

This is now needlessly difficult because most pension plans have to provide guarantees and that’s impossible if the client can swap investments and even exit investments altogether.

Retail investors start investing and then stop and defer restarting

Reducing contributions is very common.

In fact, this is another area where advisors help a lot because consistency is key to successful long-term investing.

Left on their own, it would be extremely common for them to stop investing because they want to take a nicer holiday and then to not resume investing later.

Retail investors want to buy a house

If they don’t have a house yet, they will want to use the private pension funds to buy a house. In fact, we often have clients that decide not to invest in a private pension but instead in the stock market for this reason.

If you ask Scalable capital, you'll find that people often withdraw money when they are able to buy a house.

Yet, tax-advantaged schemes cannot be used as collateral because they have no method to become liquid.

Retail investors struggle to understand tax deferral

Let alone that they understand deferred taxation.

This is one of the reason Horizon65’s client base is mostly high income, high educated people because even with the best advisors, it requires some understanding of mathematics to really understand deferred taxation.

In fact, when designing the Horizon65 app we took a lot of care to put all the numbers everything in net salary because we realized a lot of people do not intuitively understand the difference between gross and net salaries.

Young retail investors want to retire early

From age 20 to 35, most retail investors are still dreaming of retiring early.

For most, this is not an actually viable path but if you have private pension contracts and you limit the earliest retirement age to 62 then most younger investors will not invest.

Occupational pensions should really be decoupled from the company

In Germany, it’s possible to have your own privately managed company pension contract but it’s still highly restricted by labour law regulations.

Your privately-managed pension is still treated as salary and the employer is liable for the promised outcome of your company pension contract.

That’s also why the employer has to co-sign the contract (another huge point of friction).

In the US, the retirement account is truly private and the company can contribute to a private retirement account but it has no further obligations beyond that.

This is a lot simpler and easier to understand for all parties.

Expats wonder what happens when they move around

The tax benefits incurred on their savings are national in nature. That pensions lack freedom of movement is well-known and worse, pension contracts are almost never translated to English.

Nations want to retain control over tax-advantaged pension pots and are unwilling to let them be consolidated in other countries to avoid creating tax loopholes.

Retail investors care where the money is managed

Some Germans are allergic to any entity that sounds foreign (e.g. Liechtenstein Life) and strongly prefer Germany-based insurance firms. To the point they even reject Swisslife which has a fully Germany-based subsidiary.

Others prefer the opposite, they strongly prefer the money to not be in Germany because they don’t trust the German government.

Others believe Blackrock rules the world and should not be strengthened while others love Blackrock as they are cost-leaders.

In any case, retail investors want choice where and who is the custodian of their money.

Retail investors want to understand what happens when they die

There’s a reason private pensions are mostly managed by life insurance firms, many of which are more than a 100 years old!

Retail investors want to know the institution is solvent and will still be around when they need it but they also want the institution to take care of their partner.

Survivor pensions and how inheritance is dealt with are important considerations that have to be clearly explained.

A solution to private pensions that would actually work

Let’s reiterate the problems

Overconfidence in their investment abilities

Very low confidence to start investing with their money

Information overload on social media lowers confidence further

Complicated contracts

Loss-aversion especially when it comes to liquidity

Unwilling to pay for advice

They get stuck in analysis paralysis especially when they have to give up flexibility

They don’t understand taxes

They are both active and passive investors

They do not save consistently

They want to buy a house

They often want to withdraw for big expenses (car, travel)

Workplace pensions require employer signatures

Workplace pensions have restricted mandates due to mandated guarantees

Entrepreneurs rarely care about company pensions

They want to retire early

Moving around in Europe requires pausing existing contracts and opening new ones.

They want choice over where the custodian of their money is

They want to protect their partner when they pass away

They want their children (or dedicated beneficiary) to inherit their money

That’s a lot of problems!

In my next post I will design an EU-wide private pension reform that will actually work to get normal people to save money.

We europeans think we are amazing in healthcare compared to the US but we forget that the US is actually A LOT better at making sure their citizens save for retirement than the EU.

Proposal for EU-wide private pension reform

First off, the technical implementation obviously needs to have some elements such as privacy, portability, platform independence, multilingual, digital and fully private-sector based.

But I mostly want to talk about the complete solution including legal, prudential, tax and prudential concerns.

Pensions are always personal

There are occupational pensions in many countries and there are the 3 pillars (state, occupational and private).

But pensions are always tied to the individual.

There are proposals for auto-enrollment of all employees into company pensions but this is a mistake. Auto-enrollment should definitely happen, and it could be introduced through companies but they should not be tied to the company in any way.

One only has to look at the UK, where a dedicated startup exists (Pensionbee) to unify company pension pots into one or one can look at Germany where company pensions are introduced by the company but where the employer stays liable for the outcome.

In Germany there’s also a mess with changing companies, where many contracts are transferred to a new contract or just discontinued and a new one is started.

Pensions should always be personal and pension investment accounts should be tied to the person, not the company.

This requires that they are decoupled from labour law.

This doesn’t necessarily change anything on the amounts transferred into the contract and the tax benefits of such an investment.

It’s perfectly possible to have many different pension pots, following different taxation schemes in one pension investment account.

With multiple pots in one account, there is freedom to invest in everything

The government restricts tax benefits to safe investments but this actually triggers a huge amount of loss aversion among retail investors.

They STRONGLY prefer to be free to invest in what they want.

If there are multiple “pots” of money inside one account, then both can get what they want.

This also solves the issue for expats that they have multiple pension investments in multiple countries. One could follow Portugese tax benefits while the other could follow German tax law.

It also solves a critical issue for the industry, as it enables easy sign-up for a trade account (signup bonus) and then it can also be used as a pension pot for occupational pensions, tax-advantaged private pensions, …

All money pots should be liquid

Another strong point of loss aversion is the lack of flexibility to withdraw.

Governments impose these lock-in for good reasons as they are providing significant tax advantages to retail investors. In Germany the Rurup for example can lower your taxable income by €28,091. The downside is that once you wire money into such a contract you can only take it out at 62.

I strongly believe this is the wrong approach, the government should immediately match the contribution with the tax advantage AND the contracts should remain liquid.

However, should the investor want to take the money out then the tax advantage on the withdrawn money should be cancelled and capital gains tax (if applicable) should be applied on the gains.

This allows people to access the capital but it also creates a huge amount of loss aversion.

In the case of the Rurup, taking out those 28,091 euro again after one year might actually cost you €28,091 + €11,236 (40% of income tax) + €491.50 (Capital gain tax on 5% annualized interest) = €39,818

Getting 28k but losing ~12k of your balance is a very strong incentive to remain invested.

This is easily manageable with technology.

Every EU citizen should be auto-enrolled from their very first job

We are mandated to create social security numbers when we start working, this should be included in this process to make sure that every working EU citizen has a pension account.

This can be integrated with the EU pension dashboard by default.

But do note that it should be possible to switch your preferred interface away from the “basic” EU portal to a more user-friendly option.

The government should mandate companies pay 5% of the wage into the company pension pot

Importantly, THIS IS NOT A TAX as the person can withdraw the money.

However, the person will see the benefit of a company pension and has to go through loss aversion to access this.

This is intentionally designed as an opt-out system because retail investors almost always start saving too late due to indecision.

The implementation can be that the government collects the money and then deposits it into the account to avoid extra company overhead. However, the incentive for the government to raise the income tax would be enormous so it’s better the company pays it in directly without government involvement.

The % should be adjustable by the retail investor but can only be lowered for a period of 6 months. This provides a relatively frequent reminder to people that they should really save for their retirement and twice a year is not particularly burdensome.

The government should automatically invest the cash into the default investment option after one month

Retail investors are stuck in analysis paralysis and this will force them to decide where to invest OR just go with the default option selected by the private company.

This would create a lot of incentives for asset managers and banks to create really user-friendly interfaces.

In any case, the default option should fit the retail investors’ risk criteria AND be on a government curated list of allowed default options.

The “contract” should be centrally managed by an EU regulator.

This guarantees that all the legal obligations are the same across the EU and eliminates the confusion caused by retail investors trying to figure out what they are actually signing up for.

This also allows easy portability between platforms.

The pension pots should have beneficiaries for both survivors and inheritance.

The treatment of tax-benefited money varies from jurisdiction to jurisdiction and allowing them to configure their preferences for every money pot will also educate them about the treatment of their money in case of death.

The pension pots can have investment strategies and defined-benefits

To maintain compatibility with existing pension plans, some pension pots will have mandated investment strategies with guarantees.

They should also be clear where the custodian is and which company is managing the pot.

In an ideal case, the pension pot investment strategy can be adjusted and the correction in defined-benefit can be clearly agreed upon.

In effect, this is a centralization of the management of existing pension pots across the EU.

There should be pots that are direct investments and act as trading accounts

When there are no limitations imposed by the government it should act as a trading account similar to Scalable capital/Trade republic.

This means both active and passive investors are catered for, as well as those who want to invest in very risky investments without tax benefits.

This avoids loss aversion.

It also creates a situation where a very risk-averse investor is following the recommendation of a high-risk investor and is then able to adapt the investment strategy to their low-risk preferences.

The pension pots can price liquidity at different notice periods

It’s not always feasible for pension funds to divest from illiquid investments in order to payout withdrawals. In effect, a pot should be able to configure notice periods for liquidity but those should not exceed one year.

There could be alternative methods for liquidity such as providing a credit facility for pension funds to make funds liquid but charge interest which can be charged back to the retail investor.

There is an inherent conflict between long-term investing and liquidity.

The ECB should be involved as some mechanisms are needed.

In theory, guaranteeing liquidity could lead to a "bank run" on a pension fund. Therefore, a mechanism must exist to discourage withdrawals, or the ECB may need to bridge the liquidity gap, as it does for banks.

The ECB is already needed in the design for a pan-european pension framework in order to enable defined-benefit pension funds to invest more in equities.

Because many countries constructed occupational pensions as deferred compensation, there are guarantees tied to existing pension schemes. These guarantees are often so rigid and must be upheld daily due to Solvency II.

They cause many firms to adopt overly conservative investment strategies to avoid breaching the guarantee requirement and that means minimizing their investment in volatile investments such as equities.

This restrictions are not in place in US defined-benefit pension funds, who do actively invest in equities.

There should be an easy calculator to see the accrued pension adjusted for inflation when they retire

This should include their state pension actually but it has to display the amount after-taxes. This is important because many retail investors do not intuitively understand the difference between gross income and net income.

The accounts can be delegated to licensed investment advisors

Let’s face it, there are people who just don’t want to deal with finance and gladly pay others for it.

Centralizing this also allows oversight of investment advisors actual activity which will greatly help purging bad apples.

I would leave the business model and selection/recommendation of investment advisors to the private platforms

There is no really good solution to mitigate conflicts of interests with advisors and it’s unlikely a government mandate will be able to establish the needed trust.

The pots can be collateralize for mortgages or loans

People want to buy a house but it shouldn’t really be necessary that they sell their stocks to do so. Just putting the contracts up as collateral and making it easy to borrow against the liquid part of their pots should be enough.

Those collateral claims (liens) should be clearly recorded to avoid people getting multiple mortgages in parallel with the same collateral.

Conclusion

This solution works by taking advantage of loss-aversion to get people to start investing.

It’s built on the insight that loss aversion does not just apply to financial loss, it also applies to loss of freedom, loss of liquidity, loss of investment choice and loss of future life plans such as buying a house or retiring early.

Any successful scheme has to be a “no-brainer”, in the sense that the retail investor does not lose anything.

Once the funds are in the account though, the funds are automatically pushed into an safe investment which breaks the retail investors’ inertia to get started.

In my experience, once investors get started they can observe the investment and learn while doing.

The revocation of tax benefits on withdrawal is another loss-aversion mechanism to keep the funds invested and to have the retail investor face the opportunity cost of not investing it. That same opportunity cost is extra visualized in the long-term by the altered pension dashboard.

By design it is a flexible and lifelong EU pension account that clearly manages expectations of what they can expect of their investments and periodically reminds them of the importance of saving for their pension.

The multiple pension pots allow national schemes to be incorporated as well as national laws and tax regimes to be applied where necessary.