Game-tree analysis of Europe's policy responses

Europe has to stop reacting to the US and pick unconventional choices.

As argued in my previous post, America’s policy goal is to eliminate the dollar weakening effect of being the reserve currency but also to decide who is in or out of their economic zone and security umbrella.

They are pursuing a dominant strategy in doing this and so far, it’s well on track and also other VC’s have recognized that.

Many believe there is no rationale to the madness and Trump is just stupid but if you look into the backgrounds of the people behind Trump then that is absolutely not the case.

Don’t believe me that Trump is playing a strategic game?

Then believe Keith Rabois, one of the big VC’s who backed Trump and is part of the PayPal maffia (Peter Thiel, Elon Musk) who backed JD Vance and MD of one of the most successful venture capital firms.

Even non-aligned VC’s have recognized that they are playing a dominant strategy.

This comes from Silicon Valley playbooks on how to win against competition.

They’re also all computer scientists who know about Game theory trees like me.

Which is a great method to coordinate and align many stakeholders on how to plan for very complicated games.

To understand that works, let me introduce game trees first.

Game trees

Game trees are simple, in a turn-based game each players’ action constraints the actions of the other party.

The tree expands very quickly (exponentially in fact) until the game is won or lost.

There’s often also recurring elements patterns in the expansion that allows reuse of earlier results.

Mapping the game tree allows a player to always pick the choice with the highest probability of victory.

Game trees with people

People are a bit more complicated and are not strictly turn-based but they still are mostly restricted by logical choices. Even more so if they are risk-averse and follow well-socialized paths or if they require large amounts of coordination to get to a decision.

If people’s choices are so predictable then you can mark them as NPC or a “non-playing character”.

If you know Silicon Valley’s tech twitter then this term has been colloquially used for people who have no real opinion of their own and just follow the socially acceptable choice.

Those are the same people of Tech that are behind President Trump today.

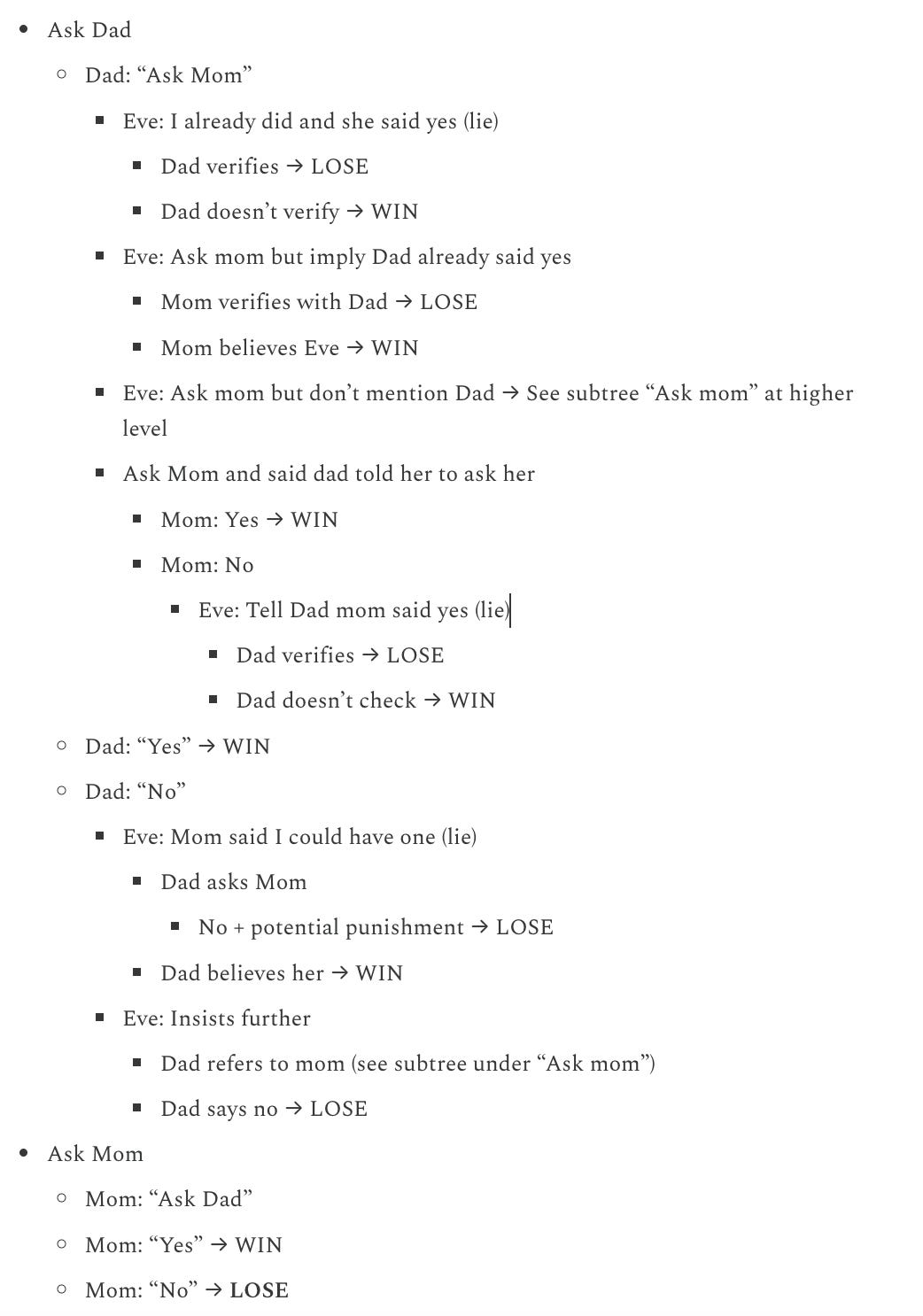

So how does a game tree with people work, let’s illustrate it with a kid trying to get candy called Eve.

Start tree:

Eve choices:

Ask Dad

Ask Mom

Now, we will go down each choice and highlight the responses.

Iteration one:

Eve choices:

Ask Dad

Dad: “Ask mom”

Dad: “Yes”

Dad: “No”

Ask Mom

Mom: “Ask Dad”

Mom: “Yes”

Mom: “No”

Now, here is where Eve’s prior knowledge of the persons’ character becomes important. Based on past experience she knows that Mom will most likely say no but Dad is more flexible but does often defer to Mom, especially when she insists.

Iterated out until leaf nodes reached:

Eve choices:

So Eve can now and assign probabilities to these events but Eve knows a behavioral trait of her Dad that she can exploit Dad almost never checks the answers she gets from mom after she is referred to ask her mom.

In this case there is just a clear winning path, where if people behave predictable is clearly dominant.

Eve’s dominant path:

Along this winning path, there’s chances to win more but her only two loss-paths are when Dad checks with Mom after he referred her AND when Dad insists on No.

Both cases she assessed as not his typical behavior and low probability, so she has very high probability of a win.

Doing such an exercise is insightful and sometimes you realize you can make some moves earlier (e.g. lie) but the real risk of this is miscalculation.

Eve wins the candy with high probability… if her analysis is correct and no unknown move was made.

For example, Dad could walk to Mom and discuss it directly which would mean a very high probability of “No”.

The unexpected move is the one that really evens the odd between the prepared and the victim

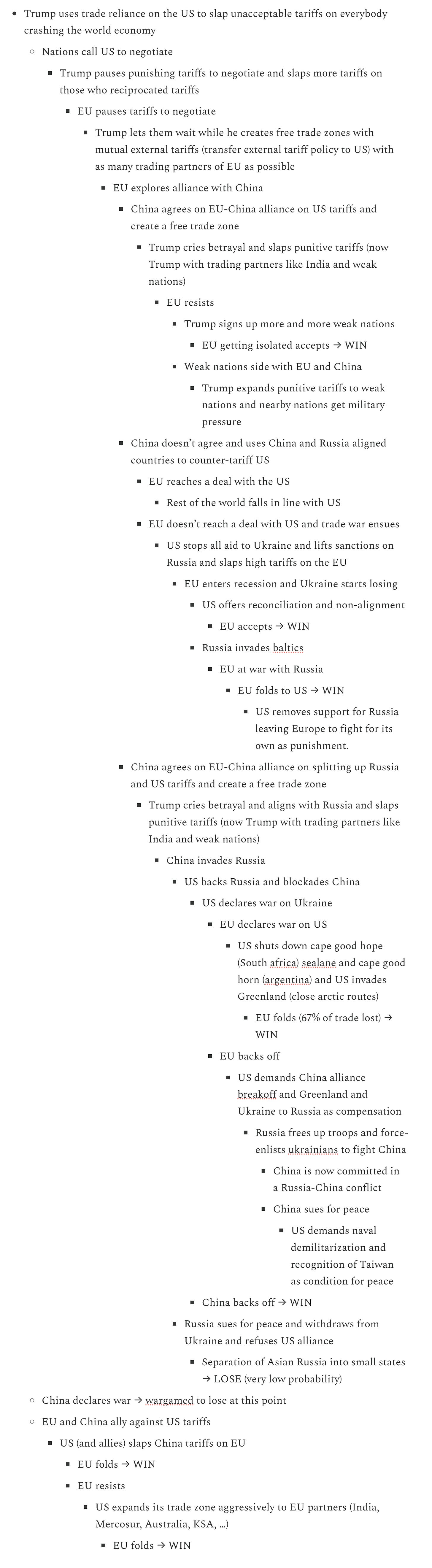

Now, in geopolitics there are just much more potential options and the tree expands very rapidly but let’s try to build a game of the current situation where America is getting other countries to pay for eliminating the dollar strengthening effect and the security umbrella.

Let’s look at the Game tree America has to do that.

Trump wants nations to burden-share for defense and eliminating the downside of the reserve currency by weakening the dollar or paying off US debt for them.

We will use “weak nations” for all trading blocks except for India, Russia, China, Ukraine and US.

Those countries are considered NPC’s in this game and act in block because they have no power to change the outcome.

Game so far:

Trump is using a dominant strategy

All the previous options have been tried and yielded a loss, so he’s taking matters in his own hands and forcing others to make decisions (including they don’t want to make).

A dominant strategy is that you win regardless of what moves the counterparties make.

In Steve Miran’s notes he mentions explicitly that EU and China will be hard to convince and Scott Bessent has openly said that they will approach China with everybody else at the end.

That implies that they expect the EU to fold, however Steve Miran also mentioned that the EU could chose to be outside the system and just pay the 10% tariff with some free trade modifications (presumably for cars and food).

Moreover in a pointed remark, Bessent likened EU-China alignment on trade a move to "cutting your own throat," emphasizing the potential economic risks of aligning with China's trade practices.

Also, Trump has threatened retaliation of 180% tariffs on any nation using BRICS as reserve currency, which has signalled his intention to harshly punish countries trying to replace the reserve currency.

Potential gameout of the future of this conflict:

There are some moves that the US can do that we can agree on will cause the EU to backoff, the threat of war and the threat of actively starting to help Russia as well as any blockade would cause us to fold.

Almost every part of this aggressively dominant strategy has EU reacting and the US escalating until one party crumbles.

Moreover, this game tree is very far from complete but the US will decide to aggressively escalate with the EU because the EU cannot fight back.

They can freely use their military to intimidate EU Allies to join their new system and even give them very good conditions because their goal is to convince the EU to join them against China.

Europe has no choice to align early with the US unless it finds an unexpected move that meaningfully changes the game and opens a new unforeseen tree

That means, Europe has to stop being a predictable NPC and let itself be played to a game others already gamed out.

Trump will build up its trade leverage with our partnering nation and it’s clear he’s using Russia’s violence as a tool to get the EU to do what he wants.

Europe absolutely has the capacity to change the conversation but it follows consensus logic which is predictable and it is easy to divide on “radical topics” which is a key weakness when playing against an opponent that had years to game out scenarios.

It’s also important to understand the other person’s redlines and finds method to push them.

The US is afraid of losing reserve asset status.

It’s clearly not afraid of a EU-China alliance because it has modelled that and know how to break it up and harshly punish the EU for such behaviour (loss of Greenland).

Europe only point of leverage is to give them an easier win that still meets their goal

If you don’t understand the game the other party is playing then you are already beaten.

In my mind there is significant leverage to offer a deal that achieves what they want but is more fair.

Alternatively, one should accept their proposal for now and subvert over time in an unforeseen way.

Another option would be to build gametrees like this, draw as much potential partners into the block and find points of leverage that would yield Trump to chicken out.

There are pressures he reacts to

Domestic public opinion

Actual large disturbance of the economy (real economy; not stock market) such as a recession.

Financial stability

Threats to reserve currency status

Weakening the US future position in a war against China

Any move that would draw out the conflict for more than 2 years (elections)

One extremely dominant move that would hit 3 pressure points and would also work to bring global trading partners into compliance is to hold the financial system hostage to force an equitable resolution.

Europe has Euroclear and Clearstream which underpins the global securities trading system, we could halt or tax the trading of US sovereign bonds.

This would not be a move they would have planned for, it’s also something that can be used to force the transition into a synthetic reserve currency asset as it will take some time to clear those assets in another clearing house.

It requires Belgium and Luxembourg cooperation on tax but Belgium can surely be bribed by paying for the two patriot batteries they need to secure their skies and potentially bailing out the Brussels regional government (which is going bankrupt with a multi-billion euro deficit).

Great Post!

Fascinating read, and a good dose of realism!